The Two Compared

Fixed income investments have returned to popularity on the back of recent market turmoil. So what is the difference between bond fund and term deposit?

The Global Financial Crisis precipitated a significant change in thinking as people reassessed the risks of their investments, especially those designed to give them a steady flow of income. With world equity markets falling to bear market lows in 2009, investors have turned back to traditional income investments like bonds and term deposits. So what are the advantages of bond over term deposit?

What are the advantages of bond fund over term deposit?

Before making a choice, it pays to look at the main differences between an investment in bonds, and an investment in a term deposit.

Firstly, a bond fund is a diversified portfolio of investments,so it effectively spreads your investment risk. A term deposit is a deposit with a single issuer bank or complying financial institution, therefore it is not diversified.

Secondly, a bond fund investment provides two types of return: income return through the receipt of bond coupon payments; and the potential for capital growth through appreciation in the market value of the underlying bond. Of course, there is also the potential for value depreciation. However, the coupon on most bonds is usually fixed, so income should remain the same, even though the market value of the underlying bonds fluctuates. Term deposit do not generate capital growth.

Term deposit pay a fixed rate of interest, but they are not tradeable, they must be held to maturity, that is, they are illiquid. While this means that depositors receive their full value back on maturity, it also means that there is no potential for any capital growth on a term deposit. If you break a term deposit before maturity there are penalties in the form of an interest rate reduction.

Returns compared

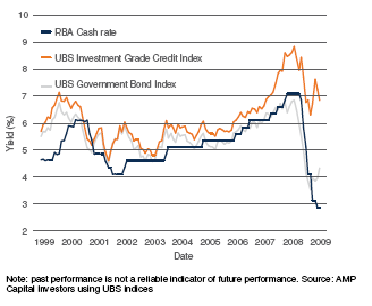

Because of their credit risk, corporate bonds typically pay yields above the cash rate. It is possible to earn higher yields from bonds than with bank term deposits which is why bonds are attractive to investors. Of course, this credit risk spread above cash is because corporate bonds come with more risks than cash.

The attraction of a bond fund is that an investment manager can secure highly rated bonds and potentially remain ahead of cash. The following chart illustrates the yields of an investment grade bond index (UBS Investment Grade Credit Index) compared with the RBA Cash Rate and the UBS Government Bond index.

Comparison of yields over a ten year period

Active management, credit risk and diversification

The key issue for investors is whether the potential for higher yields offered by a bond fund, and the additional risk, is offset by the diversification benefits an active manager can obtain by investing in multiple underlying bonds.

Bonds and risk

Term deposits are liabilities of their issuing financial institution, and therefore usually carry the same credit rating as that institution. Bond fund portfolios typically include a mix of government and corporate bonds. Therefore, the risk of a bond fund is the blend of credit risks of all the underlying bond issuers. Active bond managers rank the risks according to Standard & Poor’s or other ratings

agencies.

There are other risks in bond portfolios. These include liquidity risk, equity risk, sovereign risk, currency risk and event risk. To compensate for these higher risks bond investors require higher returns than cash.

The benefits of active management

Through active management, the investment manager of a bond portfolio has the benefit of being able to diversify risk by holding multiple bonds, while aiming to earn a higher yield than cash. Moreover, a dedicated portfolio manager typically has the resources to analyse the credit risk of all bond issuers, and can trade away from risk in the portfolio in a timely fashion, or secure higher yielding bonds where

credit risk levels are considered appropriate.

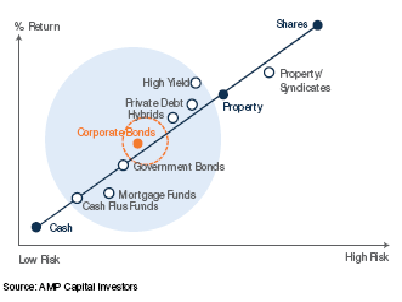

Where does a bond fund sit on the risk curve?

Typically bond portfolios sit in the orange coloured region identified in the following chart. However, the balance between government (less risky) and corporate (more risky) means that overall a bond portfolio can sit anywhere in the grey area on the risk curve.

Bond fund and term deposit compared

|

Features |

Bond Funds |

Term Deposits |

|

Income based on |

Portfolio return based on bond yields – coupon payments plus any appreciation in bond values |

Fixed rate of interest paid by issuer, usually a bank |

|

Management style |

Actively managed portfolio to beat the relevant benchmark – UBS Composite Bond (All Maturities) Index |

Passively managed, simply a deposit with a complying financial institution with a fixed term and interest rate |

|

Value can appreciate or depreciate |

Yes, with changes in interest rates because bond values adjust to interest rate changes, hence the value of a bond fund changes too |

No, generally a term deposit has a fixed rate of interest and the redeemable value remains the same and is redeemable on maturity |

|

Backed by |

Credit of underlying bonds – mix of government, bank and corporate issuers |

Individual bank issuer balance sheet |

|

Credit risk |

A mix of ratings based on the blend of underlying bonds |

Generally the same credit risk as the issuing financial institution |

|

Other risks |

Liquidity risk, equity risk, sovereign risk, event risk, and currency risk |

Sovereign risk, and event risk |

Summary

Investors look to bond funds as a means of potentially earning more than the underlying cash alternatives available from financial institutions. Unlike term deposit, bond can generate capital growth. Term deposits are not diversified, and they are relatively illiquid – early redemption is penalised. Active management of a bond portfolio can secure higher returns with the benefits of credit and risk analysis, and diversification. However, on the risk spectrum investors need to ensure they are aware of the additional risks associated with bond investments.

Source: Jeff Brunton, Head of Credit Markets, AMP Capital Investors

Visit Leenane Templeton at

Self Managed Super Fund Website

Disclaimer

The information contained in this document is based on information believed to be accurate and reliable at the time of publication. Any illustrations of past performance do not imply similar performance in the future.

To the extent permissible by law, neither we nor any of our related entities, employees, or directors gives any representation or warranty as to the reliability, accuracy or completeness of the information, or accepts any responsibility for any person acting, or refraining from acting, on the basis of information contained in this communication.

This information is of a general nature only. It is not intended as personal advice or as investment recommendation, and does not take into account the particular investment objectives, financial situation and needs of a particular investor. Before making an investment decision you should read the product disclosure statement of any financial product referred to in this newsletter and speak with your financial planner to assess whether the advice is appropriate to your particular investment objectives. financial situation and needs.

Leenane Templeton The Self-Managed Super Specialists Pty Ltd is a Corporate Authorised Representative of Lonsdale Financial Group Limited. Level 41, 120 Collins Street, Melbourne VIC 3000. Australian Financial Services Licensee, Licence Number 246934, ABN 76 006 637 225. Andrew Frith is a sub-authorised representative.

Notice

Except as required at law, Leenane Templeton The Self Managed Super Specialists Pty Ltd does not represent, warrant and/or guarantee that the integrity of this communication has been maintained nor that the communication is free of errors, virus, interception or interference. It is the responsibility of the recipient to virus check this web site and any attachments.

Comments are closed.