The popularity of Self Managed Super Funds (SMSFs) has increased substantially over the past few years. In fact, SMSFs now account for about one third of total superannuation savings.

One of their major drawcards is the broad level of investment freedom they offer. This includes the ability to invest in residential and business property, an option generally not available with other super arrangements.

Potential tax benefits

So why use an SMSF to invest in property? Well, depending on your circumstances, it can sometimes be more tax-effective to purchase a property through an SMSF than to buy it outside super.

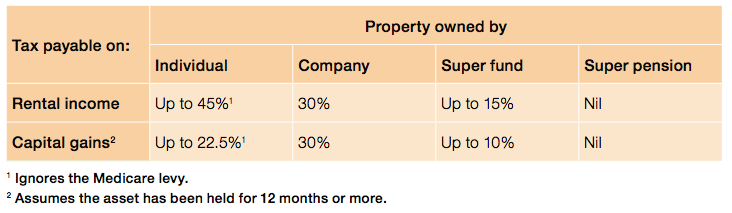

This is because rental income is taxed in super at a maximum rate of 15%. Once you retire and the fund is paying you a pension, rental income may be tax-free.

When the property is eventually sold, capital gains are taxed at 10% (if the investment has been owned for 12 months or more) and are potentially tax-free if a pension has started.

The table below compares the tax treatment of income and capital gains with other commonly used property ownership options.

Tax payable on:

Strategy tips

There’s a lot to consider when investigating the property investment options with SMSFs. As well as making sure it’s the right option for you, there are different strategies and rules to consider, such as:

- SMSFs can buy a business property from a fund member or a related party, such as a family member or related company or trust. It’s also possible to transfer ownership of a business property into an SMSF by making what’s known as an ‘in specie contribution’.

- SMSFs generally can’t purchase a residential property from a fund member or a related party.

- Buying a property through your SMSF needs to be consistent with the fund’s investment strategy.

- You can increase your SMSF’s property buying power by borrowing funds. SMSFs can only borrow to invest (using a ‘limited recourse borrowing arrangement’) in a ‘single acquirable asset’, such as a single title for land and the accompanying property, but not additional items such as furnishings.

- It’s possible to have up to four members in an SMSF. By adding family members, such as adult children, you could increase the fund’s balance considerably and increase your capacity to buy property assets.

Is an SMSF right for you?

While running an SMSF can give you greater control of your super and retirement savings, it’s a big commitment.

All members are generally required to be fund trustees and vice versa. As a result, you are responsible for meeting a range of legal and administrative obligations and penalties apply if you don’t perform your duties.

Also, to make running an SMSF a cost effective exercise, you and your fellow members will typically need upwards of $250,000 in super.

Advice and support

Given the complexities involved, a financial planner is best set to help you navigate through the complexities of an SMSF and decide whether it’s right for you.

Many planners also recommend using a comprehensive administration service that can take care of the auditing, accounting and administration needed to meet compliance obligations.

To find out more about SMSFs and investing in property, speak to your financial planner or contact our SMSF Advisors

Source: MLC, November 2012

Comments are closed.