Superannuation Strategies

There are changes afoot for your super, so here are five ways to make more of what you have.

There are changes coming with the Federal Government’s review of the superannuation industry, but many of these are gradual ones, such as the move to increase minimum compulsory employer contributions, or Superannuation Guarantee (SG), from 9% to 12% by 2019.

While 2019 may seem a long way off, Pauline Vamos, chief executive of the Association of Superannuation Funds of Australia (ASFA), an industry body for the superannuation sector, recently predicted that a higher SG would make a significant difference to retirement outcomes.

“For a person 30 today, earning $50,000 a year and with a current super account balance of $23,000, their lump sum on retirement will increase from $300,000 to $385,000 with the move to 12% SG,” says

Pauline (ASFA media release 29 June 2010).

Five Superanuation Saving Strategies

Now you can start to think about some superannuation strategies to boost your super balance.

To get an idea of how much you’ll have in retirement and how much extra you’ll need to reach your goal, speak with your financial planner.

1) Salary sacrificing can be a good bet

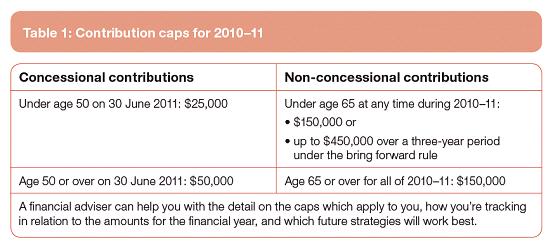

Salary sacrificed superannuation contributions are taxed at a maximum 15%, instead of your marginal tax rate, which could be as high as 46.5%, which can leave you with more super. But beware of the concessional contribution caps. (See table 1).

2) Give co-contribution a go

This applies to those with an annual income below $61,920. If you earn less than $31,920 per annum and you contribute $1,000 to superannuation during that financial year, the government could potentially match your contribution dollar for dollar. As your annual income increases up to the maximum of $61,920, the government contribution reduces.

3) Consolidate your superannuation accounts

If you’re one of the many Australians who have multiple superannuation accounts, you could be paying extra in unnecessary fees.

Consolidating your accounts could save on fees and time, and as a result may boost returns. Remember to check how the benefits in your various funds may be affected, such as insurance cover, or whether exit or withdrawal fees apply.

4) Spouse contribution tax rebate

A working person can contribute superannuation on behalf of their spouse in a number of ways which could provide some tax benefits.

Some examples include making an after-tax contribution that’s eligible for a tax rebate or splitting or transferring the working person’s salary sacrifice contributions to the spouse.

5) Align your superannuation strategies with your personal circumstances

It is important to revisit your superannuation strategies with your financial planner as your personal circumstances change. For example, have your financial responsibilities decreased and you can consider increasing your salary sacrifice amount? Or, perhaps your income has decreased, making you eligible for a government co contribution.

Source: Colonial First State, October 2010

Fro more information about self managed super funds speak with Andrew Frith, CEO of Leenane Templeton The Self Managed Super Specialists Pty Ltd and a Financial Planner

This information is of a general nature only. It is not intended as personal advice or as investment recommendation, and does not take into account the particular investment objectives, financial situation and needs of a particular investor. Before making an investment decision you should read the product disclosure statement of any financial product referred to in this newsletter and speak with your financial planner to assess whether the advice is appropriate to your particular investment objectives. financial situation and needs. Please read our full disclaimer

Superannuation strategies

Comments are closed.