Quality shares (and managed share funds) are expected to generate higher returns than most other asset classes over the long term. The return from quality shares comprises a growing income stream as well as capital growth.

How do shares generate a growing income stream – and capital growth?

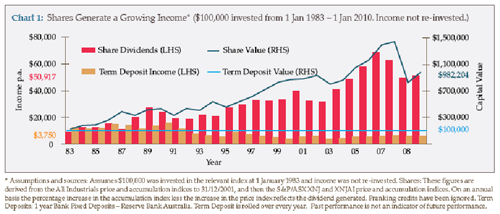

Quality shares (and managed share funds) generate a growing dividend stream for investors. As you can see in Chart 1*, the annual income generated by a $100,000 investment in shares since 1983 (with income not re-invested) started off low, but then gradually built up.

In fact, last year’s income was $50,917, or 51% on the initial $100,000 investment. The reason for the increasing dividends from shares is that quality businesses do not distribute all of their profits to shareholders. They retain some of their profit each year and use it to invest in the business – to help it grow.

If this is done well, it means they’ll have more profit the next year – from which they can afford to pay shareholders a higher dividend than they did the previous year. Plus they will again retain some profit for re-investment. So the next year their profits will hopefully be higher again, allowing the company to distribute an even higher dividend while still retaining more profit for re-investment. And even more the next year. And so on.

Of course, the more the value of the company grows as a result of the re-investment of the retained profits, the more the market will recognise this and people will pay more to buy their shares. Hence the capital growth.

Compare the income stream from shares to a well known income producing investment – the term deposit. As shown in Chart 1, a $100,000 investment in term deposits since 1983 did well while interest rates were at historical highs, but then income dropped away to just $3,750 or 3.7% in 2009. Compare that to the $50,917 income from shares last year.

In fact, since 1983, the $100,000 investment in term deposits generated a total income of just $208,350 compared to $837,772 from shares. Add to that the $882,204 in capital growth from shares – as at 1 January 2010 – and you have a total return of $1,719,976 from shares, compared to $208,350 from term deposits, as shown in Table 1.

Table 1: Shares ahead by $1,511,626 since 1983*

|

1 Jan 83 – 1 Jan 10 |

Shares |

Term Deposits

|

|

Total Income |

$837,772 |

$208,350 |

|

Growth |

$882,204 |

NIL |

|

Total |

$1,719,976 |

$208,350 |

What is the risk of investing in shares?

All shares and managed share funds experience volatility. Their values all go up and down – on a daily basis. That’s because shares are easily traded on the stock exchange. You can buy and sell shares almost whenever you want. The trade-off for that liquidity and convenience is a bumpy share price.

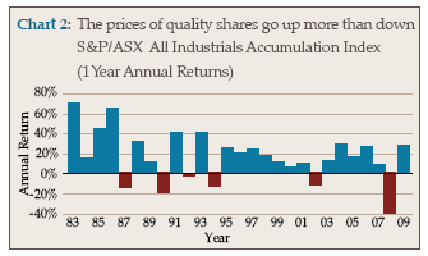

However, with quality shares (and managed share funds) you’ll notice that over time their prices go up more than they go down. And the magnitude of the price rises are generally greater than the price falls, as shown in Chart 2 of annual sharemarket returns.

As a result, over time your shares should generate solid capital growth. In fact the longer you hold your shares or managed funds the less likely you will have a negative return.

These graphs are for illustrative purposes only. Past performance is not an indicator of future performance.

Source: Australian Unity

Speak with a Leenane Templeton Advisor:

Visit our Financial Advisor Site

and Self Managed Super Fund Home

Disclaimer

The information contained in this document is based on information believed to be accurate and reliable at the time of publication. Any illustrations of past performance do not imply similar performance in the future.

To the extent permissible by law, neither we nor any of our related entities, employees, or directors gives any representation or warranty as to the reliability, accuracy or completeness of the information, or accepts any responsibility for any person acting, or refraining from acting, on the basis of information contained in this communication.

This information is of a general nature only. It is not intended as personal advice or as investment recommendation, and does not take into account the particular investment objectives, financial situation and needs of a particular investor. Before making an investment decision you should read the product disclosure statement of any financial product referred to in this newsletter and speak with your financial planner to assess whether the advice is appropriate to your particular investment objectives. financial situation and needs.

Notice

Except as required at law, Leenane Templeton The Self Managed Super Specialists Pty Ltd does not represent, warrant and/or guarantee that the integrity of this communication has been maintained nor that the communication is free of errors, virus, interception or interference. It is the responsibility of the recipient to virus check this web site and any attachments.

Comments are closed.