If you’re over 55 and still working, taking advantage of a Transition to Retirement strategy might just be the thing to give your retirement savings a boost. Whether you’re working full or part time, the strategy allows you to access your superannuation savings, while also giving you the opportunity to access some attractive tax benefits.

Most people don’t realise that their investment strategy post retirement is proportionately more important than their pre-retirement plan. In fact, accumulating wealth before your retirement is only half the story. Your focus should be equally placed on generating income for your retirement years. We should keep in mind that one of the biggest risks of investing for retirement is running out of money once you have stopped working.

On average, Australians save a constant portion of their pay through superannuation between the ages of 25 and 65, then decumulate – or draw down from their super savings – for around 25 years in retirement. But your money shouldn’t stop working even when you have, and it’s important that you have the right strategy in place to get the most out of your savings.

In this article Russell Investments discusses their 10/30/60 retirement rule which derives its name from the fact that every dollar decumulated consists of roughly:

- 10 cents of savings from your working years;

- 30 cents of investment return earned during the accumulation phase; and

- a whopping 60 cents of investment growth earned during the decumulation phase.

A ‘Transition to Retirement’ (TtR) strategy which is closely aligned to this 10/30/60 rule focuses on maximising your ability to save for retirement, regardless of your level of employment. Whether you’re employed full time or part time, a TtR strategy could be an ideal way to assist you to achieve your retirement goals.

What is a "Transition To Retirement" strategy?

The strategy involves commencing a transition to retirement pension from superannuation and, at the same time, salary sacrificing any surplus income back into a new superannuation fund.

The concept was originally devised to provide financial assistance to those wishing to transition to retirement by working part time for a period before finally leaving the workforce. As there are currently no requirements for those accessing a Transition to retirement pension to prove working status, this strategy has become popular with full time workers looking for an opportunity to boost their retirement savings.

The benefits of commencing a Transition to retirement pension arise for three reasons:

1. Once a pension has commenced, the tax on earnings from super reduces from up to 15% to nil.

2. Pension payments are totally tax free for those over 60, and taxable payments made to individuals under 60 are accompanied by a 15% tax rebate, whereas a salary is fully taxable.

3. Excess income from work can be salary sacrificed back into superannuation, which boosts your tax position even further, therefore helping you build even more for your retirement nest egg.

In a nutshell, a transition to retirement strategy creates the opportunity for you to restructure the way your income is received so that, while your day to day income may remain basically the same, your superannuation balance upon retirement can be significantly increased.

What is a Transition to Retirement pension?

A tranisition to retirement pension is an income stream that enables you to access your superannuation without actually retiring. For people under the age of 65, the minimum amount that may be paid as income each year is 4% of the account balance. There is also a maximum income cap of 10% of the account balance, which is calculated at the start of each new financial year.

Careful planning is required to optimise a transition to retirement pension, so consider speaking with a financial planner to ensure that it remains suitable for you both now and into the future.

Upon your retirement or reaching age 65 (whichever comes first) you may start to draw an income higher than 10% of the account balance if you wish. You may also choose to withdraw a lump sum from your pension after this time.

Who can access a Transition to Retirement pension?

You can access a tranistion to retirement pension if you are 55 years of age or older. Regardless of whether you are working full time and looking to reduce your hours, or working full time and loving it, you can access a transition to retirement pension.

Remember, if you do commence a transition to retirement pension but no longer need the income, there is even the flexibility to roll back your pension to the accumulation phase.

Why adopt a Transition to Retirement strategy?

The biggest investment risk you face in retirement is running out of the capital you will need to fund the rest of your life. Determining how long you need your money to last is a vital component that will impact your standard of living in retirement. Investors cannot rely on the law of averages to estimate longevity. If you find you need your income to stretch for an additional ten years to what you were expecting, you will need to squeeze an extra 2-3% each year from your investments – which can be a difficult task for any investor.

The lesson here is that longevity uncertainty becomes a greater concern than investment risk the older you get and this should be factored into investment strategies during the accumulation and decumulation phases.

Keep in mind that if you retire at 65, you may live another 20 years or more, which means you still need to be in long term planning mode. A transition to retirement strategy is an ideal way to maximise your super savings, while reducing the tax you pay – which ultimately means more money in your pocket for your retirement.

So, if you’re young at heart and want to keep working, a transition to retirement strategy may well be the answer to helping you achieve your financial goals upon retirement.

Transition to Retirement Case Study

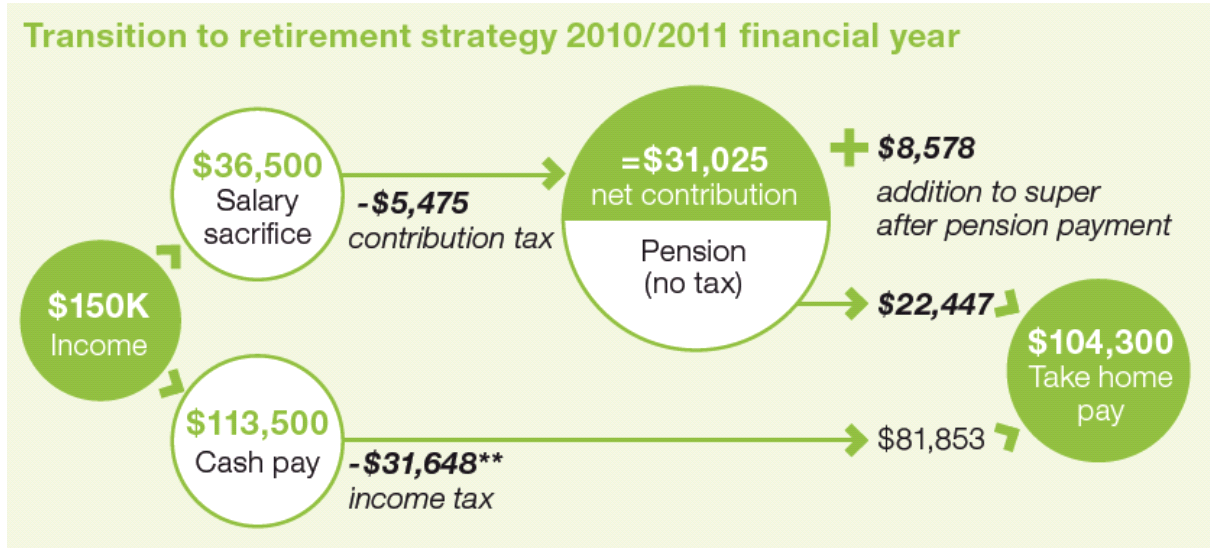

See how Bob, 60, maintains his take home pay and boosts his super balance without exceeding contribution limits.

Bob is 60 and his current salary is $150,000. He wants to implement a transition-to retirement strategy to maintain his take home pay and boost his super balance, without exceeding his concessional (before tax) contribution limit, which is $50,000.

His employer contributes $13,500 per year to his super, so he chooses to salary sacrifice $36,500, bringing the total amount to the maximum $50,000*. In combination with this salary sacrifice, he withdraws $22,447 from his pension account.

Using this strategy, Bob can maintain the same take home pay and create a net addition of $8,578 to his super, while remaining within his concessional contribution limit.

* Assumes no additional sources of concessional contributions such as employer contributions towards insurance premiums and fees.

** Including Medicare levy

Note: This is a general example and is not specific to your personal situation. The figures in this example are based on the income rates that apply in the 2010/2011 financial year.

Making a decision

The earlier you start planning, the more time you’ll have to ensure that you’re on track to achieve the retirement lifestyle you want.

Speak with your financial planner or our Self managed super fund experts about your best approach to retirement.

Source: Russell Investments, October 2011

Transition to retirement

Comments are closed.