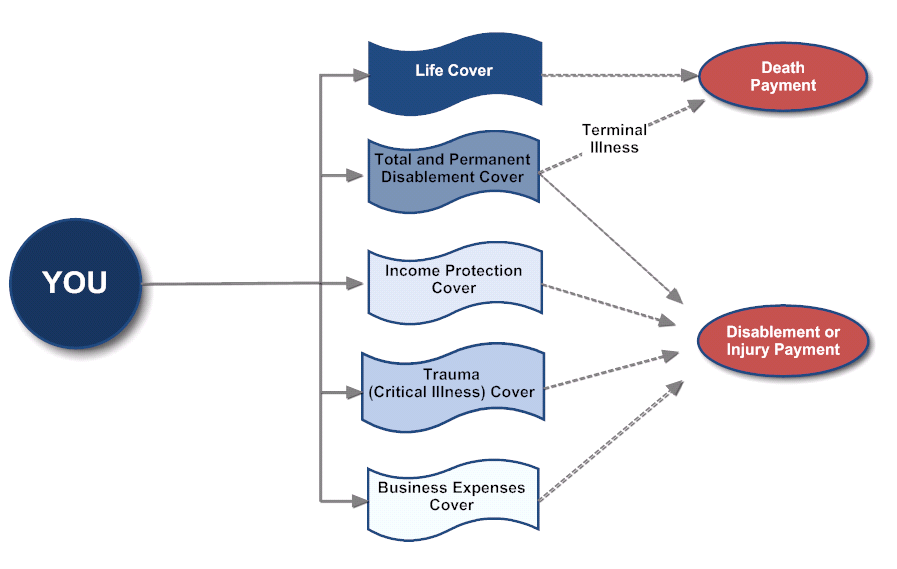

Life Insurance provides financial protection for your beneficiaries should you die or be diagnosed with a terminal illness. It provides your beneficiaries with a lump sum to help cater for their financial wellbeing, which could help cover living expenses, pay loan payments or help educate your children.

This gives you peace of mind knowing that your family is protected should you not be around to financially support them.

How much cover?

You should ensure you have enough cover to clear all of your debts, pay for the funeral, education costs and any other commitments that would be difficult to pay if the income is lost. I addition to these lump sums should be an amount that can be invested to provide an ongoing income to help cover living expenses. This is particularly important if the person who dies was the only source of income in the family.

Total and Permanent Disablement Insurance

Total and Permanent Disability (TPD) insurance provides a lump sum benefit if the person insured is unable to work due to illness or injury. TPD insurance provides more comprehensive cover than death cover alone.

If you are permanently incapacitated it may be financially difficult to meet ongoing commitments as well as medical expenses or rehabilitation costs.

The insurance company assessor needs to be satisfied that a claimant (persona insured) will never be able to return to their occupation, or one for which they are suited by education, training or experience. A TPD benefit may therefore be payable only in the event that the individual insured is unable to work in their ‘Own Occupation’ or the somewhat more restrictive ‘Any Occupation’ definition of disablement.

Own / Any Occupation (TPD)

By choosing ‘own occupation’ when purchasing TPD cover you will satisfy the definition of TPD if you are, solely as a result of sickness or injury, unlikely to ever work in your own occupation for the rest of your life. Under the ‘any occupation’ definition this is extended to include any other occupation to which you are fitted by education, training and/or experience. Note – TPD held within superannuation will always have an ‘any occupation’ definition and you must also satisfy the trustee’s condition of release.

Income Protection (Salary Continuance) Insurance

Income Protection insurance provides you with an ongoing benefit in the event that you are unable to work at full capacity due to illness or injury, and effectively replaces a portion of your normal income. It can help to meet your ongoing living expenses and commitments until such time as you are able to return to work.

Benefit Payable

A comprehensive Income Protection policy will provide replacement income up to a level of 75% of normal taxable income, during a period of temporary sickness or illness or in the event of a longer-term absence from work.

Some policies also enable you to increase the level of cover to be inclusive of the Superannuation Guarantee Contributions which would have been made by your employer if you were at work.

Benefit Period

The Benefit Period is the duration for which the benefit is payable for. The Benefit Period will generally range between one year and ‘To Age 65’. Generally the longer the benefit period, the greater the premium.

Waiting Period

In recognition of the fact that many individuals have access to cash reserves or sick leave entitlements, a Waiting Period reflects the period of time from date of accident that you must wait prior to receiving the insurance cover. Generally, the longer the waiting period, the cheaper the premium.

Deductibility of Premium

Income Protection insurance policy premiums are not tax deductible if held within superannuation. However if held personally they are able to be claimed in your tax return to reduce your assessable income. This effectively reduces the cost of the premiums.

Trauma Insurance

Trauma Insurance (also known as Critical Illness), is designed to provide a lump sum payment if the person insured is diagnosed with a serious, life threatening illness such as heart attack, cancer (including breast cancer) and other prescribed conditions.

This form of insurance can provide sufficient funds to provide a lump sum to help with your medical costs and recuperation, or any home modifications needed.

Why Trauma Insurance?

Prior to the advent of Trauma insurance, individuals who suffered such an illness were left to shoulder the full financial burden of the cost of treatment and recovery given that traditional policy types could not generally offer cover in this circumstance.

Term Life insurance benefits were not payable until death of the insured (who may well recover from the critical illness) and Total and Permanent Disability benefits were not payable unless the injury was sufficient to prevent the individual from working.

Trauma insurances addresses this ‘gap’ in cover by providing an agreed upon lump sum to provide for costs associated with a period of recuperation.

Business Expenses Insurance

Business expenses is your financial back up plan for your business.

It gives you the confidence knowing that you’ve got a plan in place to keep the business running if you’re unable to work.

Business expenses insurance covers your fixed business costs, as a monthly reimbursement, so you can focus on your recovery – and not your bills!

Business expenses insurance covers the costs of running your business while you can’t:

● office rent or fees plus interest on your property loan

● leases on cars, equipment or machinery

● insurance and security costs

● bills – such as utilities

● salaries and staff superannuation (for employees who don’t generate any business revenue)

● costs of a locum to help out while you focus on getting better

How it works

Speak with your Newcastle financial advisor about self managed super funds and insurances to make sure you have the right cover for you and your family.

Source: Lonsdale Financial Group Limited, March 2012

Comments are closed.