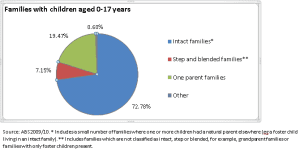

Did you know that one in three marriages ends in divorce ? It’s really no surprise then, that the number of blended families in Australia is rising . A blended family (or a step family) is simply a family where one, or both, parents have children from a previous marriage. If you, or someone you know, are in this situation, what does it mean for your finances?

As families chop and change what happens to the family fortune?

As you can imagine, a blended family can have a huge impact on your finances – whether it’s a new home or ongoing child support just as a start. While your financial adviser can help you develop a strategy to ensure that your finances continue to be managed effectively, what about your estate plan?

Perhaps one of the most important areas that is often overlooked, is the impact of these changes on your estate plan, the consequences of which can be far-reaching in the generations to come. With advice from a specialist estate planner, however, you can be sure that both the needs of your surviving spouse and all your children have been considered.

Case study – Jack and Irene

Jack has been married to Irene for five years and both have children from previous marriages. Although the step-siblings usually get on well, Jack and Irene’s marriage has created a complex family structure and, needless to say, there have been a few squabbles.

A recent death in the family prompted them to start thinking about their own estate planning needs. Jack and Irene both contribute to the home they share as well as a self-managed super fund. But in the event of one of their deaths, while they wanted to ensure that the surviving partner would be able to live in the family home and have access to a lifetime pension, they also wanted their respective assets to pass to their own children once they had both passed away.

Their financial adviser put them in touch with a trusted estate planner who informed them that if they did not change their estate plan, on Jack’s death the assets would pass to Irene, and then on Irene’s death, to Irene’s biological children – leaving Jack’s children with nothing from his estate. Similarly, if Irene passed away first her assets would pass to Jack and on his death to Jack’s biological children only.

As much as they love their step children, Jack and Irene ultimately want their assets to go to their biological children. Their estate planner recommended some changes to Jack and Irene’s estate plan to ensure their wishes were carried out after they had gone.

Jack and Irene’s estate planning strategies included the following:

| Jack and Irene’s estate planning strategies | After death of one of them | After the death of the survivor | |

| Home | Jack and Irene’s home ownership was changed from joint tenants to tenants-in-common. This way, they each have a 50 per cent interest in the property that can be dealt with in each of their Wills which were restructured as a result. | Each of them has provided the other with a right of residence for their interest in the property. This means that the survivor will be able to remain in the property for the duration of their lifetime. | The ownership of the property would pass equally to their respective children. |

| Super | Jack and Irene’s super was converted from a self-managed super fund (SMSF) to a small APRA fund (SAF). The difference between these two types of fund is the trustee structure. In an SMSF, the members of the fund are also the trustees of the fund. In a SAF, the services of a professional trustee company are employed. So, in the event that there are family disputes, the use of a professional independent trustee ensures that the wishes of the deceased are carried out regardless. | The survivor receives a tax-free pension from the deceased’s super. The annual amount of the pension has previously been set by the deceased.

|

Any balance of Jack’s super will be paid to his children. Any balance of Irene’s super will be paid to her children. |

As a result of the planning they have put in place, Jack and Irene have been able to ensure that the survivor is able to live comfortably and after they have both passed away their respective families will inherit their remaining wealth.

Incorporating a small APRA fund as part of their estate planning strategy, gave Jack and Irene peace of mind that their super would be distributed according to their wishes.

Did you know?

A self-managed super fund gives you greater control over how your superannuation benefits are invested, but it comes with strict trustee responsibilities which can become onerous. If you want the investment flexibility, but not the trustee responsibilities a small APRA fund may be more suitable and, as you can see from the case study above, can have additional benefits when it comes to estate planning for blended families.

For more information on financial planning and estate planning for blended families please speak to your financial adviser.

If you are in a blended family and would like to discuss the above article further, please contact our office.

Source: AET, October 2013