Compared to most of the world Australian super funds are loaded up on equities but do we need a better way to balance that risk? OECD studies of global pension funds contain a few pointers for Australia.

By most measures Australia’s superannuation system is a remarkable success story. With well over $1 trillion already invested and growing at one of the fastest rates in the world, the Australian superannuation market is looked upon by many as the model for managing retirement savings.

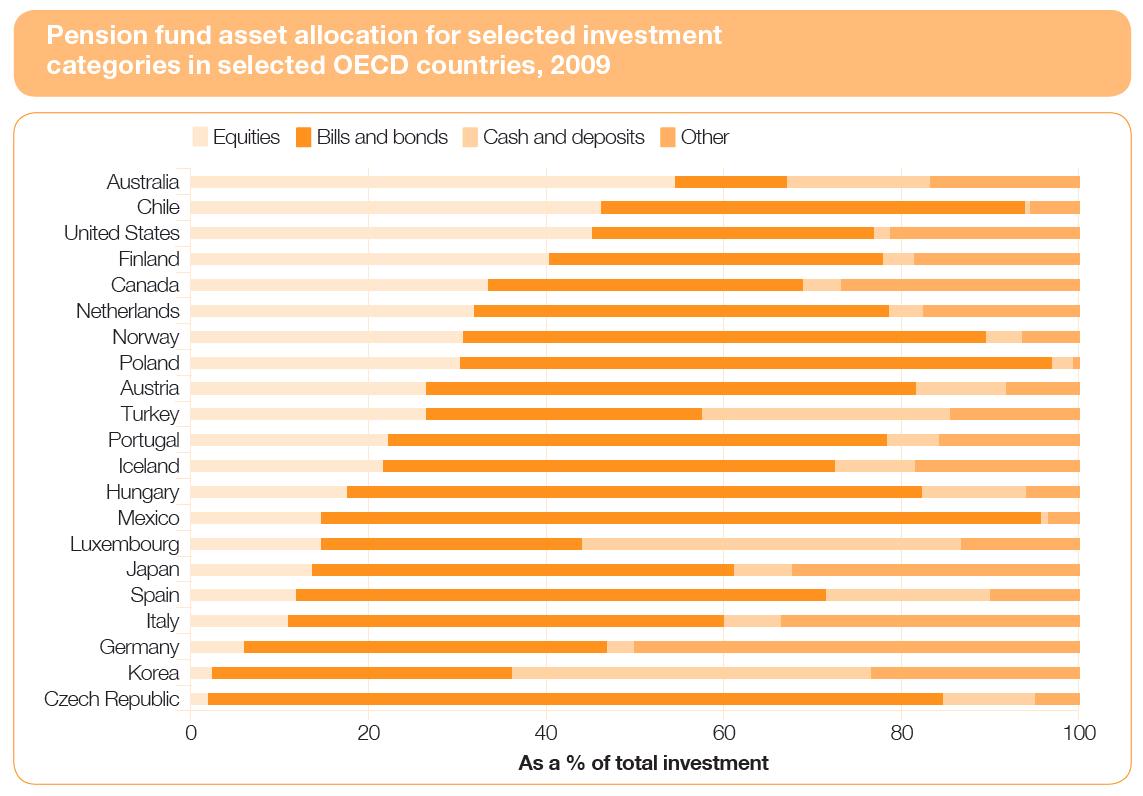

While such robust growth might make Australia a global super leader, on one score at least investors here have been out of step with many of their counterparts in the rest of the world. According to the Organisation for Economic Co-operation and Development (OECD), Australia’s super funds have the lowest allocation to bonds of the approximately 30 countries it surveys.

The OECD data puts the average exposure to bonds of Australian super funds at a paltry 14%, substantially below most other jurisdictions. For example, pension funds in 13 of the OECD countries surveyed had allocated over half of their investments to bonds.

Indeed, Australian super funds have consistently favoured share investments, with an average allocation to equities of about 60% – the highest in the world.

To a large extent Australia’s strong appetite for investing in equities can be explained by the structure of our superannuation system, which operates on a defined contribution model (i.e. on retirement, members only receive their own contributions plus whatever investment returns they may have earned).

In many other countries, a defined benefit model is the norm for pension funds, where the fund itself guarantees members a certain payout on retirement – hence the need to invest in securities like bonds that offer security of income.

As the OECD notes, the global financial crisis (GFC) highlighted some of the pitfalls for pension funds that shied away from investing in bonds. For example, the OECD says during 2008 in Chile, which has a similar superannuation system to Australia, funds with the highest exposure to equities dropped 46% while conservative funds, which invested more in bonds, broke even over the same period.

But even when compared to countries like the US and Finland that share Australia’s bias to investing in equities, Australian super funds have a lower proportion allocated to bonds. That minimal exposure to bond investments certainly hit Australia hard during the GFC.

“Australia’s superannuation funds have been heavily hit by the financial crisis, with real losses of 26.7% in 2008. This is the second worst investment performance for private pensions in the 30 OECD countries, after Ireland,” a 2009 OECD report notes.

“Investment losses in Australia were particularly large because of the large share of equities in pension-fund portfolios: around 57% before the crisis hit, compared with an average of 36% in the 20 OECD countries where data is available.”

Source: OECD Global Pension Statistics

While the justification to invest in growth assets like equities is clear enough for Australians looking to build substantial retirement assets, the OECD data also underscores the fact they’re probably not doing enough to protect their portfolios from any downturn in share markets.

Source: Aberdeen Asset Management, December 2011

Australian Super Funds

visit our main Self Managed Super website

Or click for Financial Advice help

Comments are closed.