Traditionally, SMSF trustees have effected insurance for members under a self-insurance model. This involves the SMSF trustee to take out, say, death insurance on a particular member. In the event of a claim, the insurance proceeds are allocated to the relevant member’s account in the fund. The proceeds can then be paid to the member if a valid cashing requirement has been satisfied or, on their death, to their dependants or legal personal representative.

However, there is another method growing in popularity which SMSF trustees can utilise to manage their insurance risks and cashflow positions especially when the SMSF has undertaken a limited recourse borrowing arrangement (‘LRBA’). This method is called ‘cross-insurance’. Under the cross-insurance model the SMSF trustee, on behalf of member 1, takes out an insurance policy over, for instance, the life of member 2. Assuming member 1 and 2 are business partners sharing the same SMSF which owns the business real property for their business, then cross-insurance can offer certain advantages over self-insurance.

(For simplicity we will refer to the owner of the policy as member 1 and 2 respectively, rather than the SMSF trustee. We also note that the focus of this article will be on protecting against the event of death of a member. However, there are various other types of insurance risks that should also be considered, including terminal illness, and total and permanent disability, etc.)

Cross-insurance

Why is it needed?

With the rise of LRBAs to acquire properties, many SMSFs find themselves in a position where the majority of fund assets are ‘tied up’ in property. Basically, in the event of the death of one of the members, a benefit is generally payable, but there is often little, or in some cases no, ‘liquid’ assets to pay these liabilities.

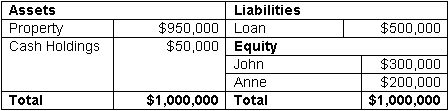

For example consider John and Anne who purchase a property in their SMSF. Their balance sheet would like something like this:

In the event of the death of John (or Anne), the SMSF trustee would need to be able to generate $300,000 (or $200,000 in Anne’s case) to meet their payment obligations to the deceased’s estate. However, as is quite evident from their balance sheet, there is clearly a disparity between the amount of cash available in the SMSF and the obligation that could arise.

Consequently, as in many funds, the SMSF trustee may need to sell the property if an unfortunate even such as death occurs unless there is adequate and appropriate insurance in place, irrespective of whether there are negative capital gains tax and stamp duty consequences or just simply poor market conditions for the sale of the property. Moreover, if the property was acquired for long-term investment purposes (especially if it is business real premises used in a related business), considerable other disadvantages can arise (eg, there may be significant relocation and transaction costs).

Why does self-insurance not work in this situation?

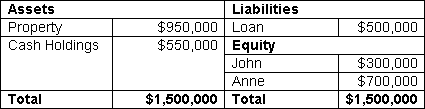

Many people ask why self-insurance doesn’t work in this context. The difficulty that arises with self-insurance is that as the SMSF trustee owns a policy with respect to each member — the insurance proceeds must be credited to that member’s account. For example, if John was to insure himself for $500,000, upon his death, the insurance proceeds would add to his equity, creating a fund liability of $800,000 that is owed to his estate. Accordingly, instead of $300,000 needing to be distributed by the SMSF trustee to his estate or dependants with $50,000 cash holdings, the SMSF trustee will need to distribute $800,000 with $550,000 of cash holdings. As is clearly evident, the SMSF will still face cash flow problems. That is, there will not be enough cash within the fund to pay out that death benefit without forcing the sale of the property.

How does cross-insurance solve this problem?

A cross-insurance policy involves the SMSF trustee taking out a policy over a member’s life, whereby premiums are debited from another member’s account. Accordingly, in the event of an insured event arising, the other member’s account is credited with the proceeds from the insurance.

In the example above, assume the SMSF trustee on behalf of Anne takes out a $500,000 insurance policy over John’s life, and that the insurance premiums attributed to that policy are debited from Anne’s account. Once John subsequently passes away the balance sheet would, immediately after the proceeds are allocated, look something like this:

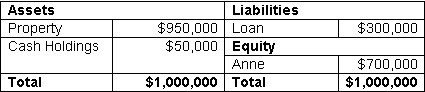

And potentially, once a payment is made to the estate of John or to his dependants, look like this:

In this situation, the SMSF trustee has reduced the loan by $200,000 and is still able to satisfy the $300,000 death benefit payment in respect of John. For completeness, we also note that Anne would probably receive some, if not all, of the distribution of John’s estate.

However, there are some other additional considerations that must be taken into account before entering into cross-insurance policy.

Issues to consider with cross-insurance

Do the governing rules of the SMSF permit a cross-insurance policy?

Before considering a cross-insurance policy, due regard should be given to the governing rules of the SMSF. If, the governing rules stipulate that any proceeds of insurance must be allocated to a deceased member’s account, then this type of arrangement cannot be utilised. However, in this situation, an appropriately worded update of the SMSF’s governing rules could be implemented.

Given cross-insurance has only recently gained popularity in an SMSF context — it is prudent to ensure the updated governing rules contain an express power dealing with this situation. Alternatively, if there is flexibility or discretion for an SMSF trustee to deal with those insurance proceeds, that an overarching deed of variation is entered into to provide certainty in how the premiums and proceeds are to be dealt with.

The ATO in the National Tax Liaison Group (‘NTLG’) Superannuation Technical subcommittee minutes of December 2012 confirmed that, among other things, where the governing rules of the fund allow for a policy of cross-insurance, and provide the mechanics for this policy to operate, that this approach is broadly allowable. Further, confirming that the insurance proceeds could be allocated to a surviving member’s account and, that this allocation would not constitute an allocation from a reserve. Thus allaying any fears relating to contribution caps.

Is cross-insurance allowable under superannuation law?

As you will appreciate, this area of law is still relatively underdeveloped. Accordingly, there is nothing within Superannuation Industry (Supervision) Act 1993 (Cth) (‘SISA’) and Superannuation Industry (Supervision) Regulations 1994 (Cth) (‘SISR’) that would preclude such a cross-insurance policy.

Interestingly, the ATO has also confirmed this position in its NTLG subcommittee minutes of June 2012, providing that:

where the trustee has determined the insurance premiums for a particular policy are to be deducted from a specific member’s account (or entitlement), it would appear consistent with SISR that the insurance proceeds received under the insurance policy should be allocated to that member’s account (or entitlement).

How much insurance should be taken out on each member?

As with many questions, the answer really is, it depends.

The purpose of the cross-insurance policy in this example is to ensure that the SMSF has enough capital to pay a benefit in the event of the death of a member without having to sell the business real premises. Therefore, the value of such policy should consider the liability that would be owed to a member in the event of death, and the amount of cash holdings that would be available to pay the benefit. This is more commonly referred to as the net equity position of the relevant member in the fund.

However, one compromise is to well over-insure, and just use cross-insurance to retain the property, with any excess balance going towards self-insurance, (ie, adding to the deceased member’s benefit).

How do we deal with excess insurance proceeds?

We suggest that a special type of buy-sell agreement is entered into by the SMSF trustee and its members in the form of a specially tailored buy sell deed of variation. This deed would stipulate, among other things, where the excess insurance proceeds are to be allocated, such as to the deceased member’s account or to be retained in the SMSF for the surviving member(s). However, we note that the ATO generally assumes the proceeds would be allocated to the same account that pays the insurance premium. Thus, unless the cross-insurance deed provides otherwise, any excess would usually end up in the member whose account pays the premium (ie, the surviving member).

A well drafted cross-insurance deed can ensure that the SMSF trustee is clear as to whom, and how, insurance proceeds are to be allocated, and therefore reduce the potential for others to challenge these allocations.

Are the Cross-insurance premiums deductible?

Unfortunately, no.

Broadly, under s 295-465(1) Income Tax Assessment Act 1997 (Cth) a deduction is only available broadly where the premium paid is for a policy that will provide insured benefit to a member. While cross-insurance policies indirectly provide cash to pay benefits to other members, in the form of insurance proceeds, they are not directly associated with the payment of a benefit to the member who suffers the insured event. ATO materials confirm this position in Example 9 in Taxation Ruling 2012/6. In this example, the premium on additional insurance that did not have a connection with a liability to pay a benefit were not deductible.

Does this meet the sole purpose test and is it consistent with the member’s investment strategy?

There has been conjecture as to whether a cross-insurance policy would satisfy the sole purpose test. That is to say, is the purpose of the insurance cover solely to provide retirement benefits for the member, or upon death, to provide benefits to the member’s dependants or legal personal representatives? If the cross-insurance policy is entered into concurrently with a cross-insurance deed, as suggested above, that stipulates that the proceeds are to be used to provide ready cash flow to satisfy the deceased member’s benefit and to reduce the fund liabilities, this still is consistent with the sole purpose test.

The trustee of an SMSF must also formulate an investment strategy that considers insurance (pursuant to s 52B(2)(f) of SISA and reg 4.09(2) of SISR). In particular where cross-insurance policies are to be implemented, we suggest that these policies are regularly reviewed together with the level of cover each year.

What if the insurance proceeds are insufficient?

For completeness we note that if the insurance proceeds are insufficient to pay out a member’s balance, then the members can always roll in proportional superannuation or contribute to the SMSF. This will create the cash flow required to pay out the deceased member’s account, without needing to sell the property. As usual these injections of capital should be subject to the relevant contribution caps.

What other issues may arise?

There are various other practical issues that will arise upon implementing a cross-insurance policy, including:

• multiple business partners: while it is simple to create a cross-insurance structure and policy for two business partners in the same fund, the structure can get more complicated where there are three or four members. Further complications arise where married couples are also involved;

• ongoing management and review: as the market values and net equity position of the SMSF will vary from year to year, requiring ongoing review and adjustment; and

• premium adjustments: some cross-insurance premiums will be greater for some members than others. Accordingly, members may desire a premium equalisation formula to be built into the cross-insurance deed to deal with this situation.

Notwithstanding these concerns, implemented correctly, cross-insurance can ensure that an SMSF that owns business real premises, which are leased to a related party, are effectively protected in the event of the death of one of the members.

Conclusion

With the rise in popularity of LRBA’s, cross-insurance presents an interesting planning opportunity. Advisers should ensure they are on top of this planning opportunity and the associated tips and traps.

This article was prepoared by Krishna Skandakumar (kskandakumar@dbalawyers.com.au), Lawyer and Dan Butler (dbutler@dbalawyers.com.au), Director, DBA Lawyers

This article is for general information only and should not be relied upon without first seeking advice from an appropriately qualified professional. If you wish to speak to one of our award winning and highly qualified advisors, please do not hesitate to contact Leenane Templeton Self-Managed Super Specialists.

04 February 2014 ($200,000 x 16.5% = $33,000) + ($210,000 x 16.5% = $34,650) $200,000 x 16.5%