A Self Managed Superannuation Fund (SMSF) is a fund which has been established for 1-4 Members and is administered by Trustees (or Directors of a Corporate Trustee) who are also the Members of the fund and typically related.

The main rationale for establishing your own SMSF is the increased level of control you have, as well as the investment choice and flexibility.

If you are considering establishing a SMSF, there are some key issues to be considered before you proceed which are detailed below. It is very important that you understand the advantages and disadvantages of establishing a SMSF prior to making a decision to proceed with setting one up. As you will become the Trustees of the fund, it is vitally important that you understand your obligations going forwards.

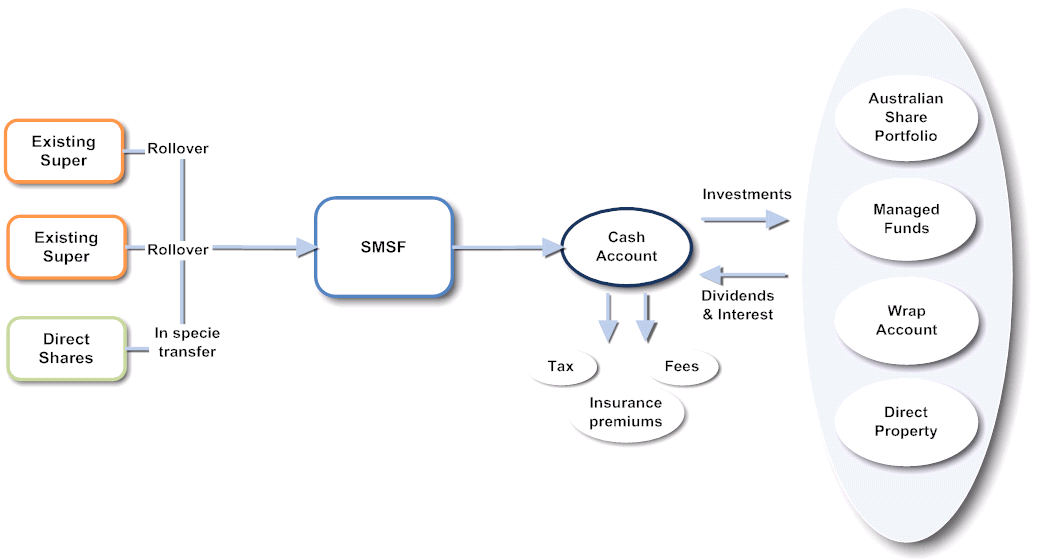

Below is a diagram summarising how an SMSF works

Obligations

While not exhaustive, the following list details some obligations of SMSF Trustees:

|

● |

As a SMSF Trustee you must at all times act in accordance with the Trust Deed of the fund and in respect of governing legislation to retain the complying status of the fund |

|

● |

At all times you act honestly, exercise skill and diligence in managing your fund and act in the best interest of all members |

|

● |

You need to prepare and implement an investment strategy for your fund, and review it regularly. The strategy needs to reflect the purpose and circumstances of your fund |

|

● |

All SMSF’s need to lodge an annual tax return with the Australian Taxation Office and are required to have the financial accounts and statements audited each year by an approved auditor |

|

● |

You need to retain detailed operations records of the fund for a period of up to 10 years in some instances |

Sole Purpose Test

The foundation of the SMSF regulatory system is the sole purpose test’ – the sole purpose of your fund should be to provide retirement benefits to fund members and death benefits for dependants.

Who are the governing bodies?

The Australian Taxation Office is responsible for overseeing the regulation of SMSFs. While the Australian Taxation Office’s regulatory approach to SMSFs is focused mainly on education and information, it is fast becoming more aggressive in its stance for fund compliance.

Separation of assets

The assets of the fund must be separate to those of a business where one or more of the trustees are involved. For instance, if the trustee is declared bankrupt or if their business is placed in receivership and the assets are held in the name of that trustee, rather than being clearly held as a part of the fund, the fund risks the loss of the asset. The failure to separate assets is a clear contravention of SIS.

Investments

To assist in making sure the assets in an SMSF are available to produce retirement funds, SMSFs are limited in the investments they can make. However, one of the concessions that the SMSFs can enjoy, is their ability to invest up to 100 per cent of the funds’ assets in a business real property. The disadvantage of this, however, is the lack of investment diversification.

It is of the utmost importance to meet fiduciary responsibilities, especially in regards to the SMSF holding its own bank account (and not personal accounts), and ensuring this account isn’t overdrawn.

Advantages of a SMSF

We consider the advantages of establishing a SMSF to be as follows:

|

● |

Appropriately run SMSF’s are complying superannuation funds and benefit from the same tax concessions as other superannuation vehicles. That is to say a maximum tax rate of 15% on investment earnings, tax deductions/offsets on contributions and concessionally taxed end benefits |

|

● |

A SMSF can pay out income streams by way of an Account Based Pension or Transition to Retirement Pension. The advantage of being able to run a pension through a SMSF structure is that the member is able to retain the assets that were held during the accumulation phase as only the tax structure is changed (from the accumulation phase to the pension phase). This means that SMSF’s are suitable as a long term financial planning tool |

|

● |

Greater flexibility is possible in the investments of the fund as the fund may invest in unusual investments (eg artwork). In practice, such exposure is generally not available through normal superannuation vehicles. Although the Trustee must establish an investment strategy, this strategy can be designed to more accurately reflect the objectives/needs of the member. Furthermore, the investment strategy can take into consideration the assets that the member holds in a personal capacity |

|

● |

Greater flexibility is possible in the overall management and administration of the fund because the member will be a Trustee ( or Director of a corporate Trustee) |

|

● |

Under the Superannuation Industry (Supervision) Act 1993 (SIS Act) and Regulations the prudential requirements for SMSF’s are less onerous. Although less restrictive, ongoing compliance is vital to retain concessional taxation treatment for your retirement capital |

|

● |

Cost savings are potentially available in relation to running the fund however this depends on the choice of investments and/or size of the capital in the superannuation fund. Costs in establishing and maintaining a personally managed superannuation fund have dropped over the last few years. Trust deeds may now be obtained for an average cost of $700 while ongoing administration and accounting costs may be around $1,000 to $2,000 per year, provided there are not too many transactions |

Disadvantages of a SMSF

The decision to commence a SMSF as your preferred superannuation fund going forward should not be undertaken lightly. It is important that you are aware of and understand the following disadvantages:

|

● |

The risk of non compliance under the SIS legislation is increased due to a potential lack of specialist superannuation knowledge |

|

● |

There is a potential inability to obtain death/disability insurance via the fund or the insurance may be at greater cost than otherwise due to losing access to group life cover |

|

● |

The costs of running a SMSF are potentially greater for smaller account balances. For example, if a SMSF has costs of $2,000 p.a. an account balance of $400,000 results in a 0.5% pa cost as a percentage of funds invested. A $50,000 balance would mean a 4% pa cost |

|

● |

Increased time needs to be set aside for the ongoing management of the fund. Although the individual has a degree of control over the level of involvement, the minimum level of involvement required is greater when compared with having funds invested in a public offer superannuation fund. Even though the accountant and financial planner may provide the on-going advice in relation to the fund, this advice must nevertheless be reviewed by the fund member(s) (who are ultimately responsible for all fund decisions in their capacity as trustee) |

|

● |

The level of skill in investing may favour the professional investor |

|

● |

SMSF’s do not have access to the Superannuation Complaints Tribunal |

|

● |

Members of SMSF’s are not eligible for the grant of financial assistance that may be provided for funds that have suffered a loss as a result of fraudulent conduct or theft |

|

● |

The Trustees of the SMSF are personally liable for any actions of the fund. Superannuation legislation places the same responsibilities on the corporate Trustee directors as it does on individual Trustees. Disputes among Trustees do occur and are a potential source of challenges and hence could be viewed as a disadvantage of setting up a SMSF by some individuals |

Speak with your financial planner or self managed super fund specialist when making decisions about the best strategies for your retirement.

Source: Lonsdale Financial Group Limited, March 2012

Comments are closed.