Given the recent volatility in sharemarkets, you may be thinking about withdrawing your money from your fund. But before you do, it’s important to evaluate the consequences.

Whether you are thinking about transferring your money to another investment, paying off some debts or buying something else, it’s important to consider the consequences of withdrawing or redeeming your investment.

Here are seven things to consider before withdrawing money from your managed fund investments.

1 The fund’s objectives and timeframe

Each managed fund has an investment objective and suggested timeframe for investment. If you have been invested for a shorter period than the suggested timeframe and withdraw, the objective of the fund may not be achieved as there hasn’t been enough time for the fund to ride out any short-term volatility.

Choosing to remain invested in a fund with a long-term timeframe through periods of volatility increases the chances of the fund achieving its objectives.

Investing for the long term, rather than trying to make short term changes, gives you the best chance of reaching your financial goals.

2 The effect on your whole portfolio

If your managed fund investment is part of a longer-term strategy, withdrawing now could mean it may take even longer for you to achieve your financial goals.

For example, if you are invested in an Australian share fund and decide to move these funds into cash, you may be sacrificing higher returns over the long term.

Moving your money into another investment may even increase the risk within your overall portfolio, due to a change in the level of diversification.

3. There will be tax implications

When you withdraw from a managed fund after it has gone down in value, you end up crystallising your loss.

This means you lose the potential for your investment to go up in value, as well as taking on that capital loss for tax purposes.

4. Time, not timing

While many investors try to ‘time’ their investments into strongly performing assets, knowing the right time to buy and sell requires as much good luck as good judgement.

Factors such as interest rates, exchange rates, commodity prices and consumer spending all come into play to influence the performance of investment markets.

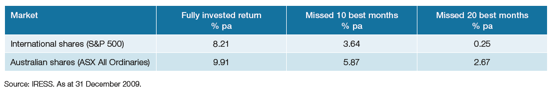

Figure 1 shows the returns of international shares and Australian shares, and what would happen if investors who tried to time the market were not invested during the 10 best months and 20 best months since 1989.

It shows that investors would have received significantly lower returns if they missed the best 10 months, and an even more significant reduction if they missed the best 20 months.

Investing for the long term, rather than trying to make short-term changes, gives you the best chance of reaching your financial goals. So when markets are fluctuating and you feel like withdrawing your investment, ask yourself whether the peace of mind is worth missing the upside when markets recover.

Figure 1 – Timing the market since December 1989

5. The grass is not always greener

While moving out of one managed fund into another may work in the short term, not all funds perform well year in, year out.

If fact, moving to a better performing fund could leave you worse off than you were before.

If you crystallise a loss, you will also be moving less money than you originally had, making it even harder for your money to go up in value.

6. Be aware of the fees to withdraw

Each fund and fund manager may charge different fees to withdraw some or all of your investment. The fees associated with withdrawing from one fund and then investing into another will impact your overall return.

It’s important that you check with your fund manager or read the latest product disclosure statement to find out the total cost of moving your money.

7. Discuss your situation with a financial advisor

You should always talk to your financial adviser before making any decision about your investments. They can help you understand what’s happened with your investment and how it fits in with your long-term investment strategy.

Come and talk with Leenane Templeton Chartered Accountants & Financial planners call 02 4926 230

The Self Managed Super Fund Specialists Pty Lyd

Offices in Sydney – Newcastle – Brisbane

FOR A FULL COPY OF THIS ARTICLE PLEASE CONTACT US.

Source: Perpetual Investment Management

This information has been prepared by Perpetual Investment Management Limited (PIML) ABN 18 000 866 535, AFSL 234426. It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial adviser, whether the information is suitable for your circumstances. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information.