All investments have some form of risk associated with them i.e. they all expose you to the chance you could lose money (either notionally or permanently). This article discusses seven of the more common types of investment risk.

The Risk of Permanent Loss of Capital

Poor quality investments usually experience falls in their value from which they never recover. In extreme cases, their value can fall to zero.

The Risk of Volatility

Investment volatility is the risk of the value of your investment moving up and down. With high quality investments, their values should move up more than they go down.

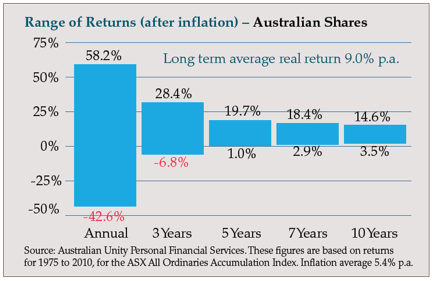

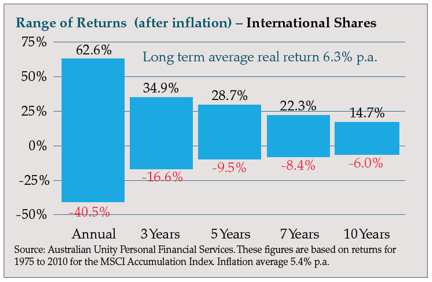

Investments which are expected to produce higher long term returns (such as shares) tend to experience higher levels of short term volatility.

On the other hand, investments which are expected to generate lower long term returns (such as bonds) usually experience less volatility in the short term.

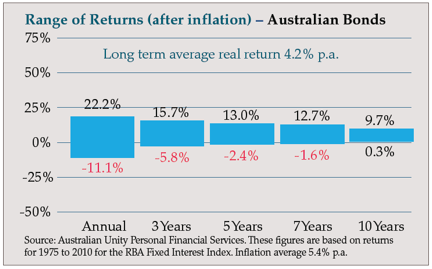

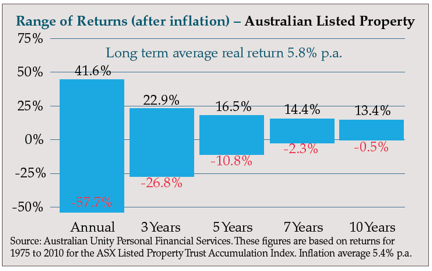

This can be seen in the charts below which show the range of historical returns for various asset classes over various periods, as well as their long term average returns.

As you can see, the longer you hold your investments the less they are affected by volatility. For example, the range of returns for Australian shares in any single year has been -42.6% to 58.2%. However, the range for 10 year periods has been 3.5% to 14.6% p.a.

Note: Investors who redeem their investments after a fall in value turn a notional loss into a permanent loss.

If they are high quality investments, this is usually a poor decision, because high quality investments should recover from falls in value.

Wealth Risk

This is where your investments do not generate sufficient returns to help you achieve your wealth or retirement objectives. This is typically the case when a person chooses not to employ an asset allocation which has a higher level of investment volatility (and also a potentially higher return). In that case, the person will need to lower their wealth or retirement expectations.

Credit risk

Credit risk usually applies to fixed term investments and means that the institution you have invested with may not be able to make the required interest payments or repay your money.

Inflation risk

This is where your money loses purchasing power because your investments do not keep pace with inflation. Cash is one investment which usually falls prey to inflation risk.

Liquidity risk

Investments which are fixed term expose you to liquidity risk. For example, if you need to access your money from fixed term investments before the term expires, you may be prevented from doing so under the contract. Or, if you can access your money, it might take longer than you want, and/or you may be charged significant penalty fees.

Poor quality share and property investments also expose you to liquidity risk. The risk is that no one will want to buy them from you or will only buy them at a substantial discount.

Currency risk

When you invest overseas, your money is usually converted to the currency of the country in which you invest.

If the Australian dollar subsequently rises in value compared to the other country’s currency, your investment will be worth less to you. On the other hand, if our dollar falls in value, your investment will be worth more.

How can you manage investment risk?

Investment risk can be managed using three prudent principles of investing:

• Only invest in high quality investments

• Construct a properly diversified portfolio

• Regularly review your investments to ensure they continue to maintain their quality.

Always speak with your financial planner when making decisions regarding your investments.

Source: Australian Unity – September 2010

The information in this document is general advice only and does not take into account the objectives, financial situation or needs of any particular person. You should obtain financial advice that addresses your specific objectives, financial situation and needs before making investment decisions. Whilst every care has been taken in the preparation of this information, Australian Unity Personal Financial Services Ltd does not guarantee the accuracy or completeness of the information. Any taxation position described is a general statement and should only be used as a guide. It does not constitute tax advice and is based on current laws and their interpretations.

Come and talk with Leenane Templeton Chartered Accountants & Financial planners call 02 4926 230

- Leenane Templeton Chartered Accountants

- Newcastle Financial Planner

- Newcastle Chartered Accountant

- Self Managed Super Fund

The Self Managed Super Fund Specialists Pty Ltd. Offices in Sydney – Newcastle – Brisbane

FOR A FULL COPY OF THIS ARTICLE PLEASE CONTACT US.